Top Challenges Faced by Coconut Brick Manufacturers Globally

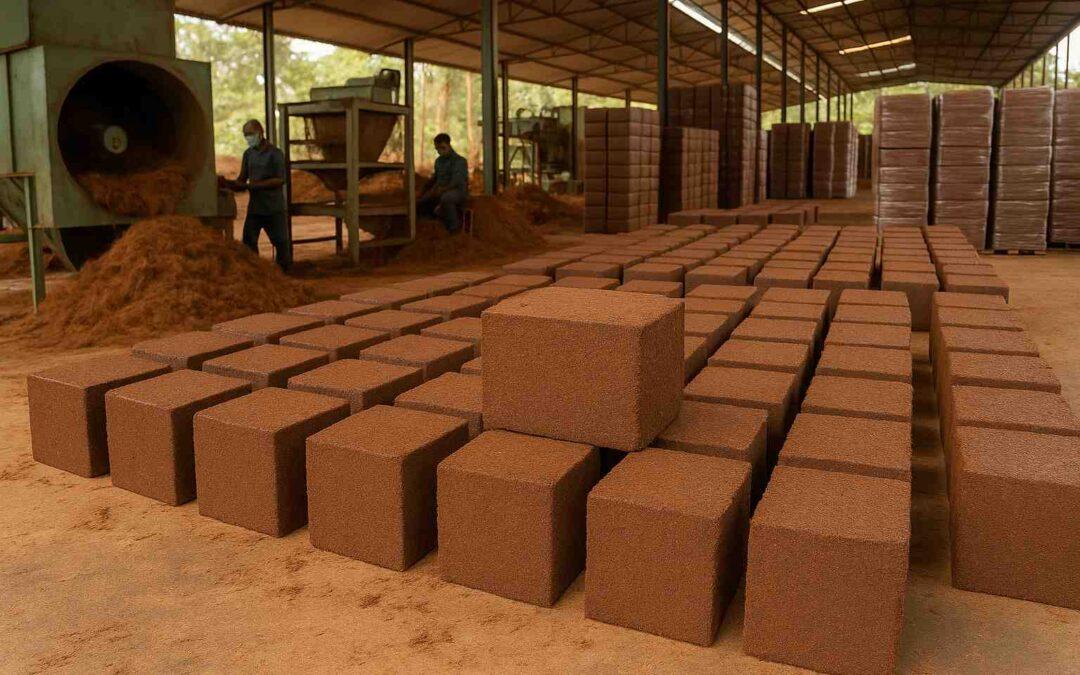

Cocopeat bricks – compressed blocks of coconut coir pith – have become a staple growing medium in horticulture and hydroponics worldwide. As demand surges for this eco-friendly peat moss alternative, coconut brick manufacturers across coconut-producing countries (like India, Sri Lanka, Vietnam, and others) must overcome significant hurdles to deliver a consistent, high-quality product.

This article outlines the top challenges coconut brick producers face, from production issues on the factory floor to complex export and business obstacles. We’ll explore the root causes of each challenge and provide actionable solutions or mitigation strategies, with insights useful for B2B buyers and general readers alike.

Production-Related Challenges

Coconut brick manufacturing involves processing coconut husks into dried, compressed blocks ready for export. Ensuring quality at each step – from drying and washing to screening and packing – is crucial for suppliers to meet global standards.

Drying Difficulties and Moisture Control

One of the earliest challenges in cocopeat production is drying the coconut coir pith to an optimal moisture level. After extracting coir fibers from coconut husks, the remaining coir pith (cocopeat) is usually sun-dried until moisture content falls below about 15–20%. Proper drying is critical – if the material is too wet, it cannot be compressed into stable bricks and may develop mold or degrade in storage. However, weather dependence makes this step tricky. In tropical regions, the rainy monsoon season brings inadequate sunlight and extremely high humidity (often 90%+), making it difficult to dry cocopeat to the required. Heavy rains not only slow evaporation but can also flood drying yards and halt coconut harvesting (workers cannot climb wet, wind-swayed trees), suddenly choking off raw material. The result is a seasonal dip in production volume and quality, often leading to supply shortages and higher prices during wet. Moreover, even in dry weather, open-air drying has pitfalls – wind can blow sand and dirt into the coir, contaminating the product.

Solutions and Strategies: Manufacturers are adopting several tactics to manage moisture and reduce weather risks. Mechanical drying systems have become a game-changer – for example, in 2016 one Sri Lankan producer introduced a mechanical dryer that achieves the necessary low moisture levels even during monsoons. Such dryers (often using heated air or rotary kilns) allow year-round production by eliminating sole reliance on sunshine. Where sun drying is still used, many factories have built large covered drying yards or concrete platforms to improve drying efficiency and keep sand out. Producers closely monitor moisture with meters and only compress cocopeat into bricks once it’s sufficiently dry (typically <20% moisture, as some import regulations also require). Maintaining the correct moisture at packaging prevents mold growth during transit. Additionally, scheduling and inventory planning helps mitigate rainy-season disruptions – manufacturers stockpile dried cocopeat or coconut bricks during the dry season to fulfill orders when drying slows down. By investing in drying infrastructure and careful moisture control, cocopeat suppliers can ensure their bricks arrive in the buyer’s hands dry, lightweight, and fungus-free despite the whims of weather.

Controlling EC (Salt Content) for Consistent Quality

Another production challenge is managing the electrical conductivity (EC) of cocopeat, which reflects its soluble salt content. Raw cocopeat naturally contains sodium, potassium, and chloride from the coconut husk (especially if sourced near coastal areas with salt spray). In fact, freshly processed coir pith can have an EC of 2–6 mS/cm – far too high for most plants. High salt content in the growing medium hinders plant growth by impairing roots’ ability to absorb water and nutrients. Therefore, quality-focused manufacturers must reduce the EC to acceptable levels (often below 0.5 mS/cm for “low EC” horticultural grade cocopeat). This is accomplished by carefully rinsing the coir with clean water to flush away surplus salts. However, the washing process itself poses challenges: it requires large volumes of water and produces saline effluent. In regions where water is scarce, intensive washing can strain local resources and raise sustainability concerns. Moreover, if washing is not done properly, batches of cocopeat may still have inconsistent EC, leading to variability in performance. Ensuring uniform salt removal across all bricks is critical, as any “hot spots” of leftover salt could harm sensitive crops.

Solutions and Strategies: Manufacturers tackle EC control by implementing rigorous washing protocols and innovative water management. Typically, coir pith is soaked and rinsed multiple times with clean water; some producers use dip tanks or washing drums to continuously flush the material. To address water usage concerns, many factories recycle and reuse wash water after filtering, and some invest in rainwater harvesting systems to supply their washing needs. This approach helps conserve freshwater resources while also minimizing the volume of wastewater released. Advanced producers take an extra step called buffering – soaking the washed cocopeat in a calcium nitrate solution – which further replaces residual sodium and potassium with calcium, then rinsing again. Buffering ensures even lower salt levels and more stable nutrient behavior, which is especially important for sensitive young plants. All these treatments are verified through frequent laboratory testing: suppliers test each batch’s EC and pH to meet international standards. By investing in proper washing infrastructure, water recycling, and quality testing, cocopeat manufacturers can consistently deliver low-EC bricks ideal for plant growth. This attention to salt content not only satisfies experienced B2B buyers (who often require a phytosanitary certificate with EC limits for import) but also ensures that even newcomers using the bricks will have a positive growing experience without unexpected salt issues.

Ensuring Consistency and Quality Control in Bricks

Delivering a uniform, reliable product is an ongoing battle for cocopeat brick makers. B2B buyers (like large nurseries or substrate distributors) expect every 5 kg brick to expand to the promised volume, have the right pH and nutrient profile, and contain no surprise contaminants. However, maintaining consistency is challenging because cocopeat is a natural product subject to variability. Different coconut husks yield coir pith with varying fiber content, color, and chemistry. Without strict controls, one batch of bricks might be fine and low-salt, while the next is fibrous, high-EC, or contains weed seeds. Inconsistent product standards have been a common complaint in the industry. Causes of inconsistency include: diverse sourcing (husk sourced from different regions or mills may differ in quality), varying processing techniques (some producers may under-wash or compress bricks to different density), and even environmental contamination. For example, if cocopeat is dried on bare ground, windblown sand can mix in, increasing the ash content and reducing the quality. There have also been cases of adulteration – lower-grade suppliers mixing cocopeat with cheaper materials like sand or powdered wood to increase weight. Any such variation can affect cocopeat’s key properties (water retention, aeration, nutrient balance), leading to unpredictable results for the end user’s crops.

Solutions and Strategies: Top manufacturers combat these issues by instituting comprehensive quality control (QC) systems from raw material to final packing. It starts with homogenizing the raw coir pith: mixing material from multiple husks lots can average out differences, and proper sieving is done to remove large fibers and dust, yielding a uniform particle size. During production, reputable suppliers maintain in-house QC labs and conduct the “five essential quality tests” on cocopeat: EC, pH, moisture content, expansion volume, and sand content. For instance, they measure how much a sample brick expands when rehydrated, to ensure it meets the expected volume. They test pH (cocopeat naturally is slightly acidic-neutral ~pH 5.5–6.5) and adjust processes if needed to keep it in plant-friendly range. Moisture tests are done so that each brick has the same low water content (too much variance could mean some bricks grow mold). Sand or ash content is checked by washing a sample – any unusually high residue would indicate contamination. Additionally, leading exporters often get third-party certifications or adhere to standards like the Indian Coir Board specifications for cocopeat EC and pH, ISO quality management, or even RHP certification (a Dutch standard for horticultural substrates) to assure buyers of consistency. On the factory floor, training workers and using modern machinery helps standardize each brick’s weight and compression. Many plants use hydraulic or mechanical block presses with set parameters to ensure every brick is pressed to the same density and size. Preventive measures are taken to avoid contamination: drying yards are kept clean (or cocopeat is dried on tarps/concrete), and finished bricks are stored in covered warehouses to prevent rodents, insects or weed seeds from getting in. Some suppliers even do microbial tests on cocopeat to ensure it’s free from harmful pathogens that could hitch a ride to the greenhouse. By rigorously controlling quality at each step and testing batches before shipment, manufacturers greatly reduce variability. This consistency not only keeps existing customers happy but also builds trust with new buyers who can rely on the bricks performing the same way every time.

Raw Material Availability and Supply Chain Constraints

Cocopeat brick production is entirely dependent on a single raw material: coconut husks. Thus, the availability of raw husk/coir pith is a critical challenge. Global cocopeat supply hinges on coconut-producing regions, and any disruption upstream can squeeze manufacturers. A major factor is the seasonality of coconut harvests and processing. Coconut trees produce year-round, but peak harvest seasons and weather events can cause fluctuations. As discussed, during extended rainy periods in South Asia, not only does drying become difficult, but farmers may harvest fewer coconuts. This leads to a double whammy: reduced incoming husk supply and slower processing, creating a supply-demand gap for cocopeat in those months. Even outside of monsoons, the coconut husk supply chain can be inefficient – many husks are traditionally discarded or used as fuel in rural areas, so getting them collected and transported to coir mills reliably is a logistical hurdle. Competition for husks adds pressure too. The coir fiber industry (making ropes, mats, etc.) uses the same husks; while cocopeat is a by-product of fiber extraction, if fiber demand drops, fewer husks are processed, potentially limiting cocopeat output. Conversely, if fiber (or cocopeat) demand spikes, husk prices can shoot up due to limited suppliers. Indeed, seasonal variations and supply chain inefficiencies directly affect the price and availability of raw coconut husks. Smaller cocopeat manufacturers often struggle to secure enough raw material in the face of larger competitors or exporters who have tied up contracts with coconut farms. Geographical concentration is also a risk – a large portion of cocopeat comes from India and Sri Lanka, so a natural disaster or policy change in those countries could impact global supply.

Solutions and Strategies: Ensuring a steady raw material supply requires strategic supply chain management and sometimes industry collaboration. Manufacturers mitigate seasonality by sourcing husks from multiple regions – for example, an Indian exporter might source not just from Tamil Nadu (which has a distinct monsoon) but also from coconut farms in Indonesia or the Philippines to balance seasonal lows. Building strong relationships (or contracts) with coconut growers and coir processing mills can secure priority access to husks. In some cases, coir companies have integrated backwards by encouraging coconut farmers to sell or give their husks (providing extra income to farmers) rather than waste them, thus enlarging the raw material pool. During times of plenty, producers often stockpile dried coir pith. Dry cocopeat can be stored for months in warehouses, so maintaining an inventory buffer helps meet orders when fresh husk intake dips. This, of course, requires working capital and storage space, but it’s a useful hedge against volatility. Technological interventions also help: mobile decorticating machines (which extract fiber and peat on-site at the farm) are being explored to reduce the loss of husks that never make it to a processing facility. In regions like the Philippines, government initiatives are underway to map and mobilize coconut husk resources for value-added products. Such programs can increase the overall raw material supply for all manufacturers. Lastly, price adjustments and planning are used to cope with scarcity – some suppliers plan their annual production and pricing knowing that monsoon-quarter output will be lower, so they might produce extra in advance or inform buyers of possible delays. By diversifying sourcing, buffering stock, and improving collection of coconut husks, the industry can soften the impact of raw material crunches. These efforts help manufacturers meet their delivery commitments and keep cocopeat brick supply more consistent for buyers year-round.

Export and Business-Related Challenges

Meeting International Compliance and Quality Standards

Cocopeat brick manufacturers not only have to satisfy their direct customers, but also the regulatory requirements of the countries they export to. Being an organic, soil-like product, cocopeat is subject to agricultural import regulations designed to prevent the spread of pests, weeds, and diseases. Navigating these compliance hurdles is a top concern for exporters. For instance, most countries demand a Phytosanitary Certificate for cocopeat shipments – an official document certifying the product is free from harmful pests and pathogens. Authorities may also impose specific treatments: Australia and New Zealand require heat treatment or fumigation to ensure no insects or fungi survive in the coir. Many markets set limits on moisture content (often <20%) to prevent microbial growth in transit, and some even watch the salt levels – the EU can reject cocopeat that isn’t properly washed and “soil-free”. If these standards aren’t met, shipments can be delayed, rejected, or destroyed. For example, a container found infested with termites or containing weed seeds might be quarantined or incinerated by customs. Even something as simple as mislabeling the product weight or origin can cause customs clearance hurdles. The patchwork of rules across different countries adds complexity – what passes in one market might need additional certification in another. Keeping track of changing import policies (such as new plant health regulations or quarantine lists) is itself challenging for manufacturers, especially smaller ones. Non-compliance not only means financial loss on that shipment, but also reputational damage and possibly losing access to a market.

Solutions and Strategies: Successful cocopeat exporters take a proactive, detail-oriented approach to compliance. First and foremost, they maintain stringent phytosanitary standards in production – this means cleaning and screening the cocopeat to remove any foreign matter (seeds, insects) and perhaps heat-treating or fumigating the final pallets before shipment if required. Many invest in onsite quality inspections and lab tests for each export batch, checking that parameters like moisture, EC, and particle size meet the destination country’s specifications. Documentation is prepared meticulously: a phytosanitary certificate from the local agriculture department is obtained for every load, attesting to its cleanliness. Exporters often also provide certificates of origin, and some pursue certifications like OMRI (Organic Materials Review Institute listing) or ISO 9001, which while not mandatory, give additional confidence to overseas clients regarding quality and traceability. Keeping an up-to-date knowledge base of regulations is key – many larger firms have compliance officers or use consultants who monitor import requirement changes (for example, the EU implemented new plant health rules in 2019 requiring all growing media imports to have certificates). In terms of packaging, manufacturers comply with international standards by properly labeling bags/blocks with all required information (origin, weight, batch, treatment, etc.). Some use palletized and shrink-wrapped packaging to ensure no recontamination occurs after processing. Working closely with experienced freight forwarders or import partners can also smooth the process – these partners double-check paperwork and coordinate any inspections. Importantly, manufacturers are learning the specific pitfalls of each region: for instance, they know to pre-wash and buffer cocopeat destined for Europe’s hydroponics market to avoid high-EC rejections, or to keep moisture well below limits for Australia’s strict biosecurity checks. By adhering to international compliance norms from the get-go, cocopeat producers prevent costly surprises at ports. This not only avoids losses but builds a reputation as a reliable, professional supplier – something B2B buyers greatly value. In summary, meticulous quality control, proper certification, and staying informed are the pillars of meeting global compliance challenges in the cocopeat trade.

Fluctuating Market Prices and Financial Pressures

Like many agri-commodities, cocopeat prices can be volatile, posing a business challenge for manufacturers and buyers alike. Fluctuating pricing is driven by several factors: seasonal supply shifts, changing demand, and global economic conditions. As noted earlier, during monsoon months when production drops, prices tend to rise due to scarcitythinkcocopeat.blogspot.com. Conversely, in peak production season, a glut might push prices down unless new demand absorbs it. Beyond seasonality, macro-level issues such as fuel costs and freight rates can swing total costs significantly. For example, a spike in global oil prices or a shortage of shipping containers elevates transportation costs, which exporters may pass on to buyers. Currency exchange rates also play a role – cocopeat is usually traded in USD; if the Indian rupee or Sri Lankan rupee fluctuates, it affects profit margins and potentially pricing strategies. Additionally, the cocopeat market has seen surges in demand (e.g. a boom in home gardening or legal cannabis cultivation can sharply increase cocopeat consumption), and if production doesn’t immediately catch up, the price per brick climbs. On the flip side, new entrants in the market or aggressive competition might lead to price undercutting (a “race to the bottom”), squeezing smaller players’ viability. All this means manufacturers often face uncertain revenues and thin margins. For B2B buyers, price swings complicate budgeting and procurement – an importer might find cocopeat costs 20% more one quarter than it did in the last, due to factors beyond their control. Small-scale producers are especially vulnerable; they may lack the capital reserves to weather periods of low prices or the cash flow to ramp up when costs (and thus working capital needs) increase. Ensuring financial stability in such a dynamic market is a real challenge.

Solutions and Strategies: To manage price volatility, both producers and buyers are adopting smarter financial and operational practices. Cocopeat manufacturers increasingly try to lock in contracts or forward agreements with large buyers at fixed or formula-based prices. Long-term contracts can buffer both parties from short-term swings (for instance, agreeing on an average price for the year, with some adjustment mechanism for extreme changes in freight cost). Additionally, larger exporters use hedging strategies for currency risk or pre-book bulk freight space when rates are low to secure better deals. On the operations side, improving efficiency is key – by streamlining production (using machinery, optimizing labor and energy use), a manufacturer lowers the cost per brick, giving more cushion to maintain stable pricing and profit even if market prices dip. Diversifying the product mix can also help stabilize income; for example, a company might sell higher-margin value-added products like cocopeat grow bags or discs alongside basic bricks, so that not all revenue is tied to the highly competitive brick segment. Some producers maintain a portion of inventory in reserve so they can respond quickly to demand spikes (selling stockpiled bricks when prices are high, which also helps cool off extreme price hikes in the market). Collaboration and information sharing within the industry can mitigate the worst swings – if exporters collectively avoid undercutting and focus on quality, the market prices tend to remain fair and sustainable rather than see-sawing. From the buyer’s perspective, it’s wise to work with reputable suppliers who are transparent about their costs (e.g. freight surcharges) and to potentially schedule purchases strategically (buying extra before an expected price rise, or staggering orders). In some regions, government export councils or coir boards monitor the industry to prevent unethical pricing and support stable exports, which indirectly helps moderate fluctuations. While cocopeat will likely never be free of market dynamics, these strategies can smooth out the extremes. By planning ahead and emphasizing efficiency, manufacturers improve their financial resilience – meaning they can continue supplying customers reliably even when conditions are less favorable.

Intense Global Competition (and Alternatives)

The cocopeat industry has grown rapidly, and with growth comes intense competition. Manufacturers face competition on two fronts: from other cocopeat-producing countries/companies and from alternative growing media products. On the global stage, multiple countries compete for market share in cocopeat exports. India is currently the largest exporter of cocopeat, followed by Sri Lanka, with emerging players like Vietnam, Indonesia, and the Philippines increasing output. This multi-country supply means buyers have many options, driving a competitive market where price and quality are key differentiators. Indian and Sri Lankan suppliers, for instance, often vie for the same customers, sometimes resulting in aggressive pricing strategies. While competition can spur improvements, it also creates pressure on manufacturers to cut costs, which if not managed carefully can lead to quality trade-offs. In addition to inter-country rivalry, there’s intra-country competition – especially in India and Sri Lanka, where dozens of small and large cocopeat factories operate. A B2B buyer shopping for cocopeat bricks online will find a long list of suppliers, all claiming best quality and price, which makes it challenging for any one producer to stand out without strong marketing, certifications, or unique offerings.

Moreover, cocopeat is not alone in the growing media world. It faces competition from alternative products such as traditional peat moss, perlite, vermiculite, rockwool, and even emerging mediums like rice hull or wood fiber mixes. Peat moss, although environmentally controversial, still has an entrenched user base in some regions and is directly interchangeable with cocopeat in many applications. Perlite and vermiculite (volcanic minerals) are often used for soil conditioning and hydroponics; they have the advantage of being inert and lightweight, and some growers prefer them or use them alongside cocopeat. In places with timber industries, composted bark or sawdust is another soil-less medium option. All these alternatives mean cocopeat suppliers must continuously prove the value proposition of their product. If, for example, shipping costs for cocopeat rise too high, a local grower might opt for locally sourced compost or peat instead. Additionally, sustainability-minded buyers in Europe or North America might sometimes question the carbon footprint of importing cocopeat versus using domestic waste products – even though cocopeat is renewable, the transport factor is considered. Therefore, cocopeat manufacturers have to educate and persuade buyers that cocopeat is worth it, highlighting its superior water retention, reusability, and renewable nature, to prevent losing business to substitutes.

Solutions and Strategies: To thrive amid competition, cocopeat brick manufacturers are focusing on differentiation, quality, and marketing. Rather than only competing on price (which can become a race to the bottom), many aim to differentiate their product through quality improvements and certifications. For example, a company might specialize in ultra-low EC, buffered cocopeat for high-tech hydroponics, setting it apart as a premium supplier for professional growers. Others ensure all their products are organically certified or sustainably produced (using solar power, biodegradable packaging, etc.), appealing to eco-conscious buyers. Building a strong brand reputation is vital – consistent quality and good customer service lead to word-of-mouth in the B2B community. Some established exporters back their quality by offering lab reports with each shipment or guaranteeing to replace any subpar batch, thereby reducing buyer risk.

In terms of marketing, manufacturers (and the industry as a whole) work to educate buyers on cocopeat’s advantages. Emphasizing that cocopeat is a renewable resource (unlike mined peat moss) and demonstrating its performance (through case studies or side-by-side trials) can convert users of peat or other media to cocopeat. Industry associations and companies often share knowledge at trade fairs and through articles, reinforcing cocopeat’s position as a modern, sustainable solution. Some suppliers diversify their offerings to be one-stop shops – selling not just cocopeat bricks, but also coco chips, fibers, or blended substrates – so they can meet various customer needs and compete better against alternative product suppliers. On the international front, while competition is stiff, there is also a spirit of collaboration among quality-focused producers to expand the overall market. For instance, Indian and Sri Lankan industry bodies have both promoted cocopeat in new markets (like North America) which in turn benefits all producers by growing total demand. Innovation is another response to competition: producers are investing in R&D to improve cocopeat products (e.g., adding beneficial microbes to cocopeat, or creating pre-fertilized coco blocks) thereby staying ahead of generic commodity sellers. Ultimately, manufacturers that maintain high standards and clearly communicate what sets their cocopeat apart are more likely to retain B2B buyers in a crowded marketplace. By continuously highlighting cocopeat’s unique benefits and delivering on promises, they can fend off both foreign competitors and alternative mediums.

Shipping and Logistics Hurdles

Getting cocopeat bricks from the factory to far-flung buyers introduces a whole set of logistical challenges. These bricks are dense and bulky when packed in large quantities, which makes transportation costly and sometimes complicated. A standard 5 kg compressed cocopeat block can expand 5–7 times in volume when rehydrated, which is great for end use but means that in its dry form It still takes up a significant amount of volume and adds substantial weight within a shipping container. Cocopeat’s relatively low density (compared to something like pure rocks or metals) means shippers often “cube out” (fill the volume) of a container before hitting the weight limit, yet a full container of cocopeat is still very heavy (~20 metric tons). This combination leads to higher freight charges – you’re essentially paying to ship a lot of bulk. Optimizing container loads is a fine art: manufacturers have developed packing configurations to maximize how many bricks fit per pallet and how many pallets per container. Nonetheless, the cost of ocean freight (or air freight for small urgent orders) remains a significant portion of cocopeat’s landed cost, and fluctuations in fuel or freight rates directly impact profitability.

Beyond cost, transport delays and risks are ever-present. Cocopeat exporters frequently deal with port congestion and shipping schedule unreliability. For example, during global shipping disruptions in recent years, containers sometimes sat at ports for weeks. Any delay is problematic because many cocopeat orders are seasonal (planting schedules won’t wait for a late shipment). Weather events can also interrupt transit – a cyclone might close a loading port, or rough seas might reroute a vessel. Additionally, because cocopeat is an organic product, it must sometimes transit with care: if a container gets water ingress or isn’t properly ventilated in a long transit, the cocopeat could develop mold. Manufacturers have to ensure the product is well wrapped and sometimes include desiccants to control humidity inside the packaging. Another issue is customs clearance and paperwork during transit (especially for intermodal shipments). If documentation isn’t in order, a container can get held up at the destination port’s customs, incurring storage fees and frustrating the buyer. Each country’s import process can differ (as covered in compliance), so logistics teams must coordinate closely with importers to ensure smooth handoff. There’s also the challenge of inland logistics: moving containers from the factory (often in rural coconut-growing areas) to the seaport requires trucks, which may face road infrastructure issues or regional transport strikes. All told, the logistics of moving heavy cocopeat bricks across continents require careful management, and any snag along the way can cause financial losses or customer dissatisfaction.

Solutions and Strategies: Effective logistics management is crucial for cocopeat manufacturers and exporters. To tackle high freight costs, exporters often negotiate bulk rates with shipping lines or use freight consolidators. By shipping high volumes regularly, they can secure better per-unit rates which helps keep their pricing competitive. Some explore alternative routes or ports (for instance, using a less congested port even if it’s farther, to avoid delays). In terms of packing, there’s continuous improvement: vacuum-packing or tighter compression techniques can reduce volume. A newer trend is to ship cocopeat as big bales or mega bulk bags in break-bulk ships for very large orders, which can be more cost-effective than containerized bricks for certain markets – though the handling infrastructure needs to be in place on both ends.

To mitigate delays, leading suppliers build buffer time into their delivery schedules. If transit is expected to take 4 weeks, they might quote 6 weeks to the client, allowing room for unforeseen holdups. Clear communication with buyers is also a strategy: keeping the buyer updated on shipment status, so if a delay occurs, the buyer can adjust their plans (e.g., a distributor can manage their inventory accordingly). Many companies diversify their shipping options: if one port is jammed, they can route via another, or if one shipping line is overbooked, they have an alternate lined up. In critical situations, some even split shipments – sending a small urgent quantity by air freight to tide the buyer over, while the rest comes by sea.

It’s essential to thoroughly verify all export documentation before shipment to ensure smooth customs and import clearance.

Exporters send advance copies of documents to the importers and brokers so that any issue (like a typo in the botanical name on the phytosanitary certificate) can be corrected while the ship is en route rather than discovered last minute. Working with experienced customs brokers and freight forwarders ensures that import regulations are met and paperwork is filed correctly. Some exporters obtain pre-clearance or participate in fast-track trade programs if available, to speed up the customs process. On the physical side, ensuring containers are properly sealed and sometimes using food-grade containers or liners can prevent water damage or contamination in transit. Companies also pay attention to warehouse and storage practices: cocopeat must be kept dry prior to loading, and if a container is held at a port, keeping it shaded or moving it to a dry warehouse can prevent rain exposure. Insurance is another safety net – cargo insurance can cover losses if something goes awry during shipment. In summary, through meticulous planning, strong logistics partnerships, and building in safeguards, cocopeat manufacturers work to get their product delivered in a timely and cost-efficient manner. This logistical reliability is a big part of what B2B buyers look for in a supplier, often as important as the product quality itself.

Buyer Education and Market Awareness

Lastly, an often underappreciated challenge is the need for buyer education and managing customer expectations. Cocopeat bricks, while popular, are still a product that some growers or buyers are not completely familiar with. Especially when entering new markets, manufacturers encounter knowledge gaps among end-users about how to use cocopeat effectively or why it’s beneficial. A general reader or first-time buyer might not know, for instance, that a 5 kg cocopeat brick needs 25–30 liters of water to rehydrate, or that you should rinse a high-EC brick before using it for salt-sensitive plants. If buyers (be it hobbyist gardeners or even some farmers) misuse the product due to lack of guidance, it can lead to poor results – and the product or supplier might get blamed for what is essentially an educational issue. For B2B buyers like importers or distributors, there can be misunderstandings about cocopeat grades and specifications. A landscape company might purchase bricks not realizing they needed the low EC grade for their purpose, or a greenhouse might overwater seedlings in cocopeat thinking it behaves like soil, ending up with waterlogged roots. Thus, educating buyers on cocopeat’s proper handling and its advantages is crucial for manufacturers to ensure customer success and repeat business. Additionally, because cocopeat competes with traditional options, part of “buyer education” is also convincing potential users to switch – many growers used peat moss or soil for decades and may be hesitant to try a coconut-based medium without understanding its benefits.Limited awareness among potential users can hinder the widespread acceptance of the product in the market. From the manufacturer’s perspective, a well-informed customer base reduces the number of complaints and issues they have to troubleshoot. It also allows them to sell value-added features (“this cocopeat is buffered/calibrated for you”) to an appreciative audience rather than those who might not understand the differences.

Solutions and Strategies: Cocopeat manufacturers and industry groups are actively working to educate and inform buyers at all levels. On the product usage side, many suppliers include detailed instructions with their bricks (or on their websites) about how to hydrate the brick, how to mix it with other components (like perlite or compost if desired), and how to manage nutrients when growing in inert cocopeat. Providing this info helps new users avoid mistakes and get the best results. Some companies create tutorial videos or infographics demonstrating the expansion process and the do’s and don’ts of cocopeat. For large agricultural clients, some exporters have agronomists or technical sales reps who train the buyer’s staff on using cocopeat, whether it’s how to fill pots properly or how to adjust fertilizer programs for cocopeat-based cultivation. This kind of support greatly increases customer confidence. In terms of product selection, good suppliers clearly label and explain their different cocopeat grades (for example, “High EC (unwashed) – for industrial absorbent use or salt-tolerant plants” vs “Low EC (pre-washed) – ideal for young plants and broad horticultural use.” This helps buyers choose the right product for their needs, avoiding mismatch issues. Manufacturers also highlight certifications or lab test results to assure buyers of what they are getting – e.g., listing the pH and EC on the packaging, so the buyer isn’t guessing.

Beyond direct usage guidance, marketing and awareness campaigns play a role in expanding cocopeat adoption. Articles, blog posts, and presence in farming expos help spread knowledge about cocopeat’s environmental benefits and performance advantages. For instance, emphasizing that cocopeat is a sustainable alternative to peat moss that doesn’t contribute to wetland destruction can sway eco-minded customers. Demonstrating successful case studies – like a greenhouse that achieved higher yield using cocopeat – can convert skeptics. Industry stakeholders have noted that increasing such awareness is key to market growth. To that end, some manufacturers partner with agricultural universities or research institutions to publish findings on cocopeat, lending scientific credibility that educates the market. In summary, by proactively providing information, whether through instruction manuals, customer support, or broader marketing, cocopeat manufacturers turn the challenge of buyer education into an opportunity. An educated buyer not only uses the product correctly (leading to good outcomes and satisfaction) but is also likely to appreciate the value of a high-quality cocopeat brick – making them more loyal in the long run. This effort ultimately benefits both newcomers and seasoned industry professionals, as it raises the knowledge level across the board and solidifies cocopeat’s reputation in the global horticulture community.

Outlook

Cocopeat brick manufacturers globally operate at the intersection of agriculture and international trade, and as we’ve detailed, they face a diverse array of challenges. From the production floor – mastering drying under fickle weather, controlling salt content, ensuring every compressed brick meets quality specs, and securing enough coconut husk supply – to the business front – complying with stringent import regulations, riding out price swings, standing strong amid competition, streamlining logistics, and educating their market – it’s a complex juggling act. The good news is that the industry has shown remarkable adaptability and innovation in tackling these hurdles. Manufacturers are investing in technology (from mechanical dryers to advanced packaging), adopting best practices in quality control, and collaborating with partners and authorities to smooth out the rough edges of exporting an organic product worldwide. Many of the solutions not only overcome challenges but also add value: for example, strict washing and quality tests mean a superior product for the end user, and buyer education builds trust that grows the market for everyone.

For B2B buyers and general readers, understanding these behind-the-scenes challenges offers a new appreciation for cocopeat bricks. It explains why, for instance, prices might fluctuate seasonally or why one supplier’s product might differ from another’s. Importers can use this knowledge to choose partners who are proactive about solutions – such as those with quality certifications or robust logistics plans – ensuring a more reliable supply chain. Growers and consumers, on the other hand, can feel confident that despite the complexities, the cocopeat industry is maturing and continuously improving its standards globally.

In an era where sustainable growing media are in high demand, cocopeat has carved out a vital role. By addressing the production and export challenges through innovation, consistency, and education, cocopeat manufacturers are not only overcoming obstacles but are also driving the global growth of a green industry. The result is a win-win: growers around the world get a dependable, eco-friendly medium for their plants, and coconut-producing communities gain value-added business that supports local economies. As the industry moves forward, continued focus on quality, compliance, and sustainability will be key. The challenges are significant, but with each challenge conquered, cocopeat solidifies its place as a cornerstone of modern horticulture – proving that even a humble coconut husk can connect, from coconut plantations in the tropics to flourishing gardens across the globe, this shift marks a remarkable journey of sustainability and innovation.